Fund Your Soft Goods Startup

Launching a startup in the soft goods industry is an exciting venture combining creativity and business acumen. However, one of the most daunting aspects for many entrepreneurs is securing the necessary funding to realize their vision. Whether you’re looking to produce bespoke textiles, fashion items, or other soft goods, understanding the financial landscape is critical. This guide will navigate you through the different financing options available, helping you make informed decisions that align with your business goals.

We’ll explore a variety of funding sources, from traditional loans to more innovative approaches like crowdfunding and venture capital. Additionally, we’ll provide practical advice on approaching potential investors, managing your funds effectively, and planning for future financial needs. By the end of this guide, you should have a solid foundation to financially support your startup journey, ensuring you’re well-equipped to manage the challenges and opportunities that lie ahead.

Understanding Your Financing Needs

Before exploring the vast world of financing options, it’s important to understand the kind of capital you need. In the soft goods industry, startup costs can vary widely depending on the scale and scope of your business.

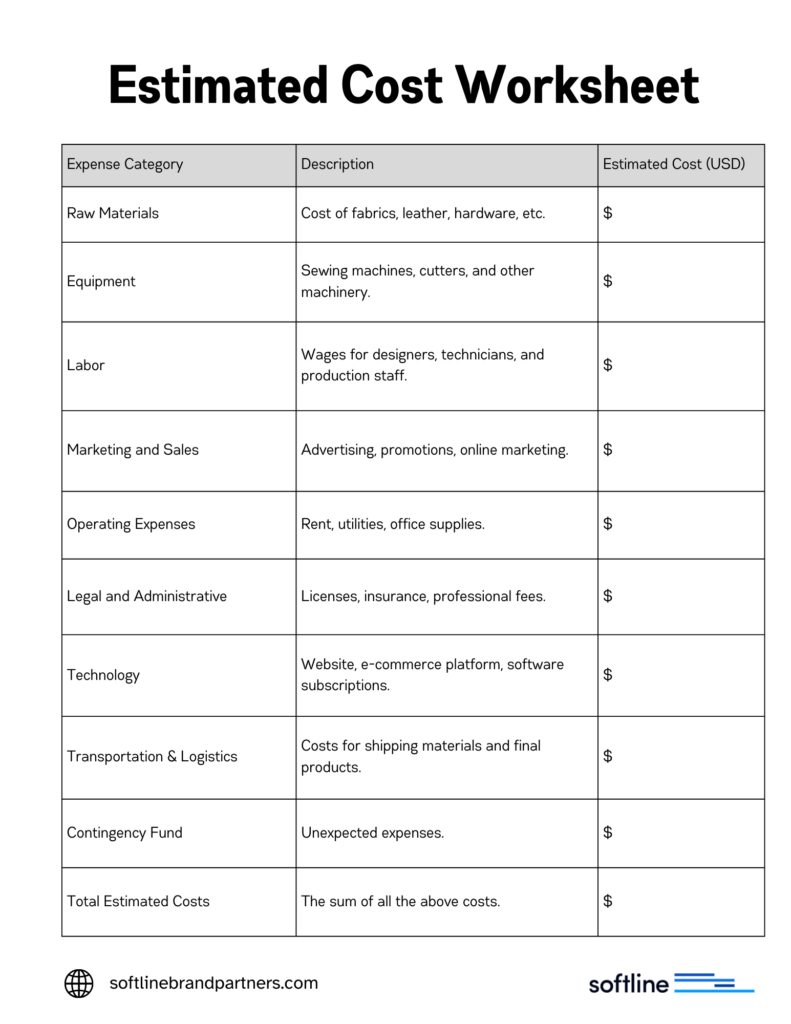

Here’s a detailed list of initial expenses to consider when planning your startup budget. This comprehensive understanding will be the groundwork for your financial strategy:

- Raw Materials: Costs associated with acquiring fabrics, leathers, threads, and other essential materials necessary for production.

- Equipment: Expenses for purchasing or leasing manufacturing equipment such as sewing machines, cutters, and pressing machines.

- Labor: Wages or salaries for designers, technicians, production staff, and other employees.

- Marketing and Sales: Investment in advertising, promotions, online marketing, trade shows, and other sales activities to build brand awareness and market your products.

- Operating Expenses: Monthly expenses include rent for your workspace, utilities, insurance, and office supplies.

- Technology: The costs of software needed for design (e.g., CAD software), production management, and customer relationship management (CRM) systems.

- Logistics and Shipping: Expenses related to storing, distributing, and shipping materials and final products.

- Legal and Professional Fees: These include costs for legal advice on patents, trademarks, or incorporation and fees for accountants or business consultants.

- Licenses and Permits: Necessary fees for operating legally in your local area or internationally.

- Emergency Fund: A reserve of funds allocated for unexpected costs and challenges that may arise.

As you account for these expenses, consider using our estimated cost worksheet to help organize and predict your financial needs effectively. This worksheet will guide you through forecasting your initial costs and preparing your financial roadmap.

Download the Estimated Cost Worksheet

Planning Your Financial Roadmap

A well-planned financial roadmap helps you navigate the early stages of your business and ensure long-term viability. This detailed plan should encompass several vital components that will help you manage your startup’s finances effectively:

Budgeting

Effective budgeting allows you to outline monthly and yearly spending, essential for monitoring cash flow and ensuring your business operations are financially sustainable. A good budgeting strategy involves the following:

- Identifying Fixed Costs: These are expenses that do not change monthly, such as rent, salaries, and insurance.

- Estimating Variable Costs: These costs fluctuate with business activity, such as raw material purchases, utility, and marketing expenditures.

- Setting aside a Contingency Fund: A contingency fund covers unexpected expenses or financial downturns, ensuring that such surprises don’t derail your business operations.

Financial Projections

Forecasting your sales, profits, and expenses for at least the first three years is vital for setting realistic goals and measuring progress. This includes:

- Sales Forecasting: If available, estimate future sales based on market research, industry trends, and historical sales data.

- Profit Projections: Estimate your profits based on your sales forecasts and anticipated expenses to understand potential financial returns.

- Cash Flow Analysis: This helps predict how cash will move in and out of your business, ensuring you have enough to cover expenses.

Tools and Resources

To efficiently manage your financial roadmap, several tools and resources can be utilized:

- QuickBooks Online: Ideal for budgeting and financial planning, offering features that help track expenses, manage invoices, and even handle payroll. QuickBooks Online

- Xero: Known for its user-friendly interface, Xero provides effective financial reporting, direct bank feeds, invoicing, and payroll. Explore Xero

- Microsoft Excel or Google Sheets: Spreadsheets help create detailed financial projections and budgets. They offer flexibility in setting up your forecasts and can be as detailed as necessary for your needs. Get Google Sheets

Incorporating these tools into your financial planning process can significantly enhance your ability to monitor financial health and make informed decisions. Regularly updating your financial roadmap allows you to adapt to changes within your business or external economic conditions, ensuring sustained growth and profitability.

With a clear understanding of your financial needs and a roadmap in place, the next step is to explore various sources of financing that can turn your soft goods startup from concept to reality. Whether through self-funding or seeking external investors, choosing the right financing option will depend on the capital required, your business model, and your personal risk tolerance. Let’s examine available funding avenues to find the one that best suits your venture.

Sources of Financing for Your Soft Goods Startup

Each funding source has its benefits and limitations, and choosing the right one can depend on your business model, financial needs, and long-term goals. Let’s explore the most common financing options available to entrepreneurs in the soft goods industry.

Self-Funding

Self-funding, or bootstrapping, involves using your financial resources to support your business. This might include savings, personal loans, or even selling personal assets. The advantage of self-funding is retaining complete control over your business without the need to answer to external investors.

Advantages:

- Complete control over your business decisions.

- Avoid diluting equity early in your business lifecycle.

Risks:

- Potentially exhausting your savings.

- Limited funds restrict growth.

Tips for Self-Funding:

- Budget Wisely: Ensure you have a buffer to cover expected and unexpected costs.

- Limit Risk: Avoid putting all your assets at risk if possible.

Friends and Family

Funding from friends and family is a standard early-stage financing option. It’s generally more straightforward and quicker to secure than formal investment options. However, mixing business with personal relationships requires clear communication and agreements.

How to Approach:

- Be professional and present a clear business plan and expectations.

- Discuss potential risks and the realistic possibility of loss.

Setting Terms:

- Formalize Agreements: Use promissory notes or equity agreements to clarify terms.

- Clear Communication: Regular updates about the business’s progress can help maintain trust.

Bank Loans

Bank loans are a traditional source of funding that can provide significant capital with structured repayment terms. Types of loans include term loans, lines of credit, and SBA loans, often partially guaranteed by the government.

Types of Bank Loans:

- Term Loans: Lump sum loans paid back over a set period.

- Lines of Credit: Flexible borrowing options, only pay interest on the amount used.

- SBA Loans: Small Business Administration loans designed to help new businesses grow.

Securing a Bank Loan:

- Build a Strong Business Plan: Demonstrate how you will generate revenue and repay the loan.

- Maintain Good Credit: Both personal and business credit scores are crucial.

Resources:

- U.S. Small Business Administration for guidelines on SBA loans.

Venture Capital and Angel Investors

Venture capital (VC) and angel investors provide capital in exchange for equity in the company. VC firms usually invest in more significant amounts at later stages than angel investors, who typically support startups at the early stages.

Pitching to Investors:

- Clear Value Proposition: Demonstrate a scalable business model and a potential for high returns.

- Strong Team: Show that your team has the skills to execute the business plan.

Resources:

- AngelList for finding potential angel investors.

- Crunchbase to research and connect with venture capitalists.

Crowdfunding

Crowdfunding platforms like Kickstarter and Indiegogo allow you to raise funds by pre-selling products or offering rewards to backers. This method can also be a marketing tool, helping you gauge consumer interest and receive feedback.

Best Practices:

- Compelling Campaigns: Create engaging content and clear calls to action.

- Realistic Goals: Set achievable funding targets to ensure campaign success.

- Update Regularly: Keep backers informed to help build community and trust.

Resources:

- Kickstarter for product-based crowdfunding.

- Indiegogo for more flexible funding options.

After exploring these personal and external funding sources, another viable option for your startup might be leveraging government grants and support programs. These can provide non-dilutive funding to help further your innovations without giving up equity. In the next section, we’ll explore how to locate and apply for these grants and highlight the specific support programs that can benefit soft goods startups.

Government Grants and Support Programs

Securing government grants and participating in support programs can provide significant non-dilutive funding to help launch and grow your soft goods startup. These options do not require giving up equity in your company and can offer substantial resources, including financial support, mentoring, and access to networks. This section explores how to find, apply for, and utilize these opportunities.

Federal and State Grants

Government grants are awarded to businesses that meet specific criteria and typically focus on innovation, research, and development that align with government interests, such as economic growth or technological advancement.

Finding Grants:

- Utilize the official government grants website Grants.gov, which provides a comprehensive database of available federal grants. You can search based on eligibility, category, or agency to find grants relevant to your soft goods startup.

- Check state government websites. Many states offer grants that should be listed on federal sites. These can be more accessible and targeted towards small businesses.

Application Process:

- Read Requirements Carefully: Ensure your business meets all eligibility criteria before applying.

- Prepare a Detailed Proposal: Many grants require a proposal that outlines how the funds will be used, the expected outcomes, and how it aligns with the grant’s objectives.

- Follow Application Guidelines: Submit all requested documentation, adhere to format guidelines, and meet the deadlines.

Incubators and Accelerators

These programs provide startups with seed investment, mentorship, office space, and access to a network of investors and mentors. They are precious for startups looking to scale quickly.

Benefits:

- Seed Investment: Although not as large as typical venture capital funding, it’s often enough to get operations running.

- Mentorship and Guidance: Access to industry experts and business mentors can help refine your business model and strategy.

- Networking Opportunities: Connect with other entrepreneurs, potential customers, and investors.

Finding the Right Program:

- Research: Look for incubators and accelerators tailored to the fashion industry or manufacturing. For instance, Manufacture NY is a fashion incubator offering services from workspace to mentoring.

- Evaluate Fit: Consider the program’s focus areas, the success of previous companies, and the kind of support they offer.

Specialized Economic Development Programs

Many regions offer economic development programs, such as tax incentives, reduced-rent facilities, and direct grants, to foster local business growth.

Opportunities to Explore:

- Local Economic Development Agencies: These agencies often run programs that support small businesses with financial incentives and resources to help them grow and contribute to the local economy.

- Industry-Specific Incentives: Some areas support industries they want to develop, such as tech, sustainable goods, or fashion.

Resources:

- The Economic Development Administration (EDA) provides information on regional programs and grants available to businesses in different sectors.

- Local Chamber of Commerce: Often has resources or can direct you to regional economic development incentives.

Once you secure funding through grants, loans, or investors, the next critical step is to take control of your financial destiny through effective financial management. This ensures sustainability and scalability, putting the power in your hands. In the next section, we’ll cover essential strategies for budget management, reinvestment into your business, and planning for future financial rounds to help your startup thrive long-term, empowering you to steer your startup toward success.

Managing Finances Post-Funding

After successfully securing funding for your soft goods startup, the next crucial phase is effective financial management. This stage is vital for maintaining financial health, ensuring sustainability, and preparing for future growth. This section will guide you through best practices in financial management, budgeting strategies, and planning for subsequent funding rounds.

Effective Use of Capital

Once you have obtained funding, how you manage and allocate these resources can significantly impact your business’s success.

Budgeting for Growth:

- Strategic Allocation: Prioritize spending on activities that directly contribute to growth, such as production scale-up, marketing, and sales expansion.

- Cost Control: Regularly review and manage operational costs to avoid unnecessary expenditures that can deplete your financial resources.

Monitoring Cash Flow:

- Cash Flow Management: Implement tools and processes to monitor cash flow meticulously. Tools like QuickBooks or Xero provide excellent visibility into your financial status, helping you make informed decisions.

- Emergency Fund: Always maintain a reserve fund to manage unexpected situations without disrupting your operational capabilities.

Reinvesting in Your Business

Reinvestment is crucial for sustaining growth and adapting to market demands.

Reinvestment Strategies:

- R&D Investment: Continuously invest in product development and innovation to stay competitive and meet market trends.

- Technology Upgrades: Invest in technology to improve efficiency, such as upgraded manufacturing equipment or new software systems.

- Staff Training: Developing your team’s skills can enhance productivity and innovation within your company.

Resources for Reinvestment:

- Look for industry-specific grants or additional funding opportunities that support expansion and technology upgrades, such as those offered by Manufacturing.gov, a portal for manufacturing initiatives in the U.S.

Planning for Additional Funding Rounds

As your business grows, you may require additional funding rounds. Planning these is essential to ensure they support strategic growth without undue disruption.

- Evaluating the Need for More Funding:

- Growth Milestones: Assess your business growth and set clear milestones that require additional funding.

- Market Opportunities: Consider expanding into new markets or product lines that require capital injection for research, marketing, or inventory.

- Preparing for Investor Engagement:

- Update Business Plans: Regularly update your business plan to reflect current operations, future goals, and strategies to achieve them.

- Maintain Investor Relations: Keep current and potential investors informed about your progress and plans, which can facilitate further investment when needed.

- Resources for Funding Rounds:

- Utilize platforms like Crunchbase to research potential investors and track industry funding trends.

- Engage with financial advisors or investment banks that specialize in preparing companies for subsequent funding rounds.

Proper financial management post-funding is about keeping your business afloat and strategically positioning it for sustainable growth and success. Utilize the tools, strategies, and resources mentioned to maximize the impact of your received funding and prepare for future financial needs.

This comprehensive approach ensures not only the survival of your startup but also its ability to thrive and expand in the competitive landscape of the soft goods industry.